The Premier, the finance minister, and their favourite economist are talking about tax increases, layoffs, and spending cuts.

They are talking about cuts and layoffs at a time when the provincial government has more money coming into its accounts than any government in the history of Newfoundland and Labrador before 2003.

The provincial government finances are in a mess.

The place is in a mess because of decisions made by finance minister Tom Marshall and his colleagues over most of the last decade. They made decisions for the short-term that benefited them politically. They spent money and made themselves popular.

Tom and his colleagues made bad decisions. They had a very simple idea. As finance minister Tom Marshall told CBC’s David Cochrane recently, when he had money, he spent it and now that there isn’t money, there’ll be cuts.

Tom Marshall calls it “responsible”. Most people would call it bullshit.

Dependence on Oil

It’s bullshit because there’s no surprise in anything that is going on. Take oil revenues for example. Marshall told Cochrane that prices for commodities are are down so we are suffering because the government isn’t getting as much money as it would otherwise.

For one thing, Marshall has known for some time now – actually since he took office – that the provincial government’s oil revenue would be dropping off around now. The finance department, for one department, knew that oil production would drop off steadily after an initial peak in the middle of the last decade.

What’s more, Marshall has known that except for a brief jump once Hebron oil starts flowing around 2017, production will trail off. Even Marshall’s pet economist - Wade Locke – has been noting that provincial oil revenues will, inevitably go the same way, even if oil prices stayed relatively high.

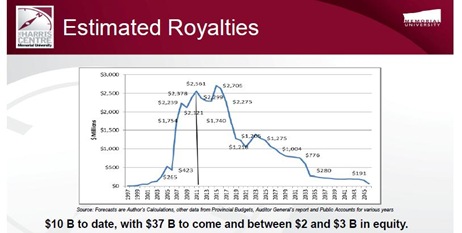

Here’s a slide from Locke’s 2011 proposal for the provincial government to create something Locke called a prosperity plan

To go with that, here are the most recent oil production forecasts, by the way.

Locke’s 2011 proposal included all the forecasts of a looming debt crisis. Locke forecast the serious problem to be years away. He managed to do that by basing his assessment on rosy projections for oil prices. Locke didn’t consider for a moment – apparently – what might happen if oil prices went down. His near-term forecast was for provincial government revenue from oil to work out around what Marshall used in his budget. And if the provincial government bought into that sort of overly rosy forecast from Locke or anyone else, you can see how Marshall and his colleagues continued to make the bad strategic choices they’ve obviously made over a very long period of time.

Over the next five years, the provincial government oil revenues will likely go down. Look at that chart. Realise that Marshall and his colleagues have known about that since 2003. Then realise that they get about 50% of more of their annual income from oil and minerals, directly and indirectly.

The logical conclusion to be drawn from the evidence seems really obvious. How people could draw a different conclusion isn’t clear at all.

Deliberate Overspending

This is not something new. Marshall and his colleagues planned to overspend. In the 2012 budget, for example, if everything turned out just as Marshall forecast in his budget, he’d have run a cash deficit of more than a billion dollars. What is happening is worse than forecast but what Marshall forecast originally wasn’t really very good.

Marshall and Premier Kathy Dunderdale blame the spending on things like the recession. Well, that’s a nice story but it isn’t true. Marshall’s predecessor - Loyola Sullivan - promised to overspend the budget back in 2005 and to keep doing so for the foreseeable future.

The Tories kept their promise. Every single, annual edition of the Estimates from 2004 onward has forecast a deficit. Some were as high as $1.3 billion.

The only years when the Tories produced surpluses were ones when either oil prices went wildly out beyond what anyone expected or, as in 2011, when the budget contained huge amounts of spending the government just chopped out.

Spectacular Mismanagement

For a few years, skyrocketing oil prices delivered billions in windfall cash to the provincial government. The windfalls totalled almost $5.0 billion at one point.

The Tories had a simple plan for the cash. In 2009, then-Premier Danny Williams told a California energy conference that the province would be investing its oil cash in a new energy project on the Lower Churchill.

That was their plan.

Problem was that those same politicians hewed up all the surplus cash to cover their annual deficit spending. The last of the money is scheduled to cover the 2012 mess, as Tom Marshall told reporters in December. Where once the provincial government could have used its own cash for the equity share of the megaproject, the current plan is to pay for the entire cost of Muskrat Falls through borrowing either by the provincial government or Nalcor. In addition, the provincial government will likely resume borrowing next year to meet annual budget deficits.

The current financial mess in Newfoundland and Labrador may not look to some like the problems in Greece, nor did it come from the same sorts of causes.

This mess was manufactured right here.

-srbp-